Aider - The Launch of a Startup

Aider began as a vision to improve Sweden’s trustee system, an essential but often flawed service designed to support vulnerable individuals. Ulf Matsson, who had spent years as a trustee for his sister, experienced firsthand the system’s shortcomings. Between navigating cumbersome administrative duties and hearing stories of predatory trustees exploiting their clients, Ulf realized the system needed a change.

That’s where Aider came in. As part of the initial team of four, I worked on design and frontend development for two years, helping transform Ulf’s idea into a fully functional product now widely used by trustees in Sweden.

The Problem

Sweden’s trustee system supports people with disabilities, the elderly, and others who need help managing their day-to-day affairs. Trustees assist with essential tasks like handling expenses, taxes, and overall financial well-being. However, the system is far from perfect:

- Cumbersome Administration: Trustees deal with mountains of paperwork and manual processes, leaving less time to focus on the actual needs of the people they’re supporting.

- Lack of Oversight: Some trustees take advantage of the system, mismanaging or even stealing from their clients due to insufficient monitoring by municipalities.

- Inefficient Tools: Existing processes and tools failed to streamline tasks or provide transparency, adding unnecessary complexity to trustees’ responsibilities.

Ulf envisioned a solution: an app that could simplify administrative duties, ensure accountability, and allow trustees to focus on the personal care that matters most.

The MVP

We started by diving deep into the world of trustees. Through interviews and workshops with trustees and municipal stakeholders, we mapped out their pain points and workflows. Turns out trustees weren't the only people frustrated with the system. Municipalities tasked with monitoring trustees had few options when it came to detecting fraudulent behavior. Their process at the time relied on sampling yearly reports at random, and due to the many different formats, they were unable to process more than a couple every year.

MVP Key Features

- Bank API Integration: By connecting directly to bank APIs, the app could fetch up-to-date account statements, automating a significant portion of the trustee’s administrative tasks.

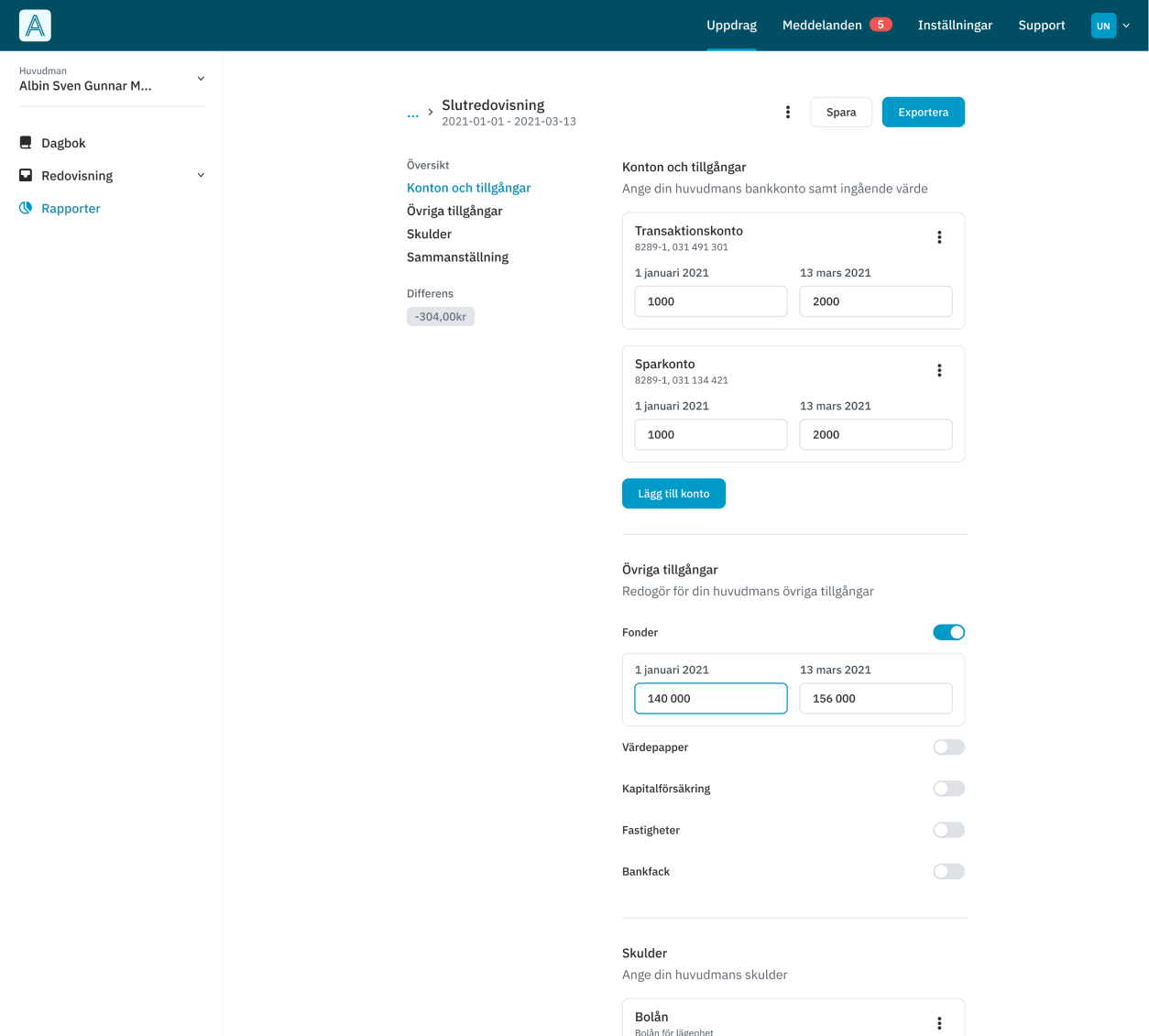

- Automated Reports: Trustees could generate financial reports with just a few clicks, meeting regulatory requirements without the usual hassle. And since every single transaction has to be accounted for, the risk for fraud is significantly lowered. Also, reports share a similar format making auditing a breeze compared to custom made excel sheets.

- BankID authorization: The app is only accessible through BankID, ensuring that sensitive information remain safe.

- Native and Web: Trustees are constantly on the go. Providing a seamless experience across devices ensured they could manage their responsibilities efficiently, no matter where they were.

Pivots, Financing and Moving Forward

In hindsight processes like these often seem straight-forward. The reality of launching something completely new rarely is. We knew that we wanted to start out with making the lives of the trustees easier, and with our MVP in place we really started to get some traction. Our ultimate goal was to bring municipalities on board. The vision was for them to adopt Aider as the standard reporting tool for trustees, purchasing app licenses and encouraging its use across their networks to ensure consistency and transparency. We soon realized how slow-moving public offices could be.

With limited financing, we had to make a tough choice: either double down on municipalities to secure long-term adoption or pivot to a B2C model, allowing trustees to sign up for the app directly and start generating revenue immediately. We opted for a B2C model and officially released the app with a free tier, allowing trustees across Sweden to start using it immediately. Over time, this approach created momentum and increased demand, putting pressure on municipalities to adopt Aider as their recommended tool. Looking back, it was the right decision for scaling the platform and achieving widespread adoption.

Product Overview

Keeping Everything in Sync

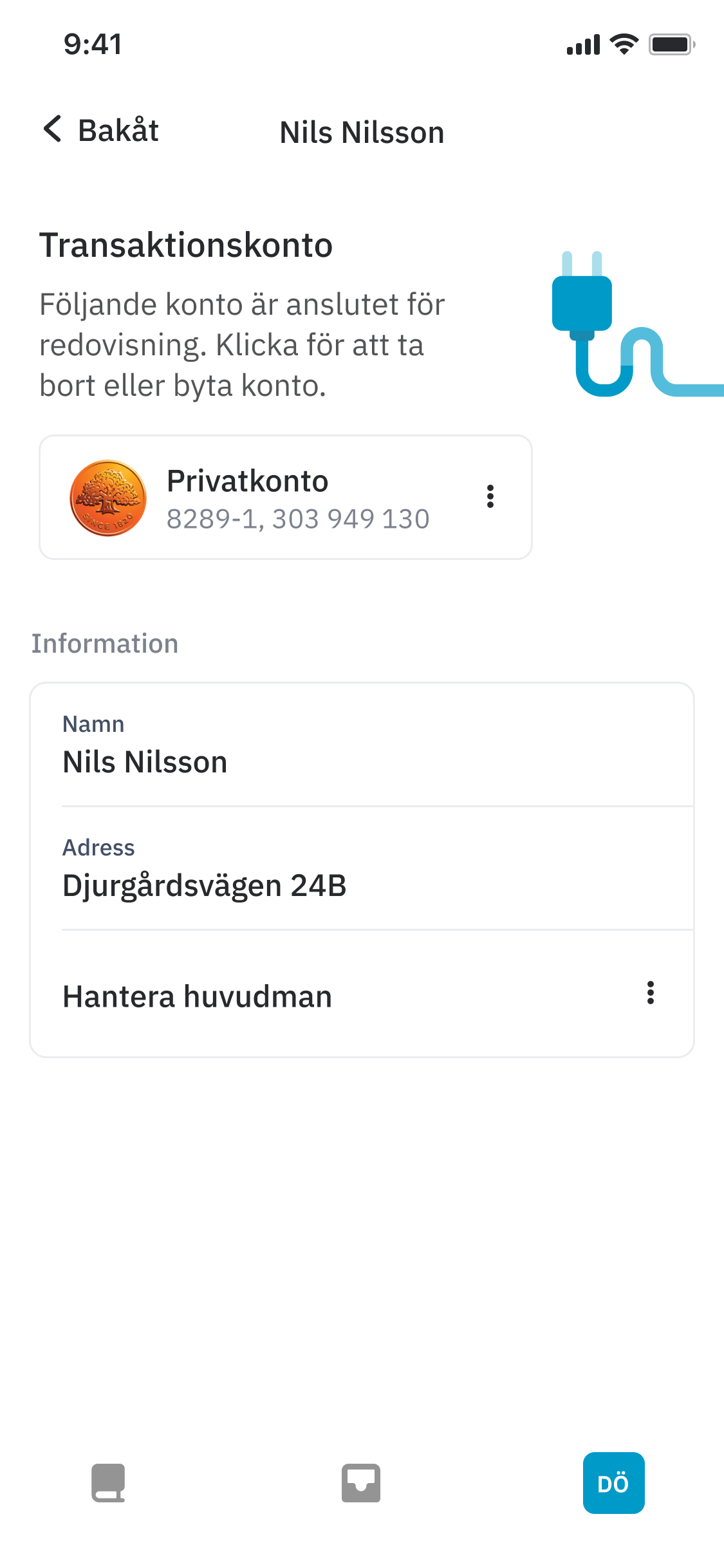

We used Tink as our bank API provider. Tink is a Swedish fintech company that provides a platform for banks and other financial institutions to access aggregated financial data, initiate payments, and build personal finance management tools. By connecting to Tink, we could fetch account statements and transactions in real-time, ensuring trustees always had the most up-to-date information.

Trustees can connect their shared bank account with each of their clients.

Accounting

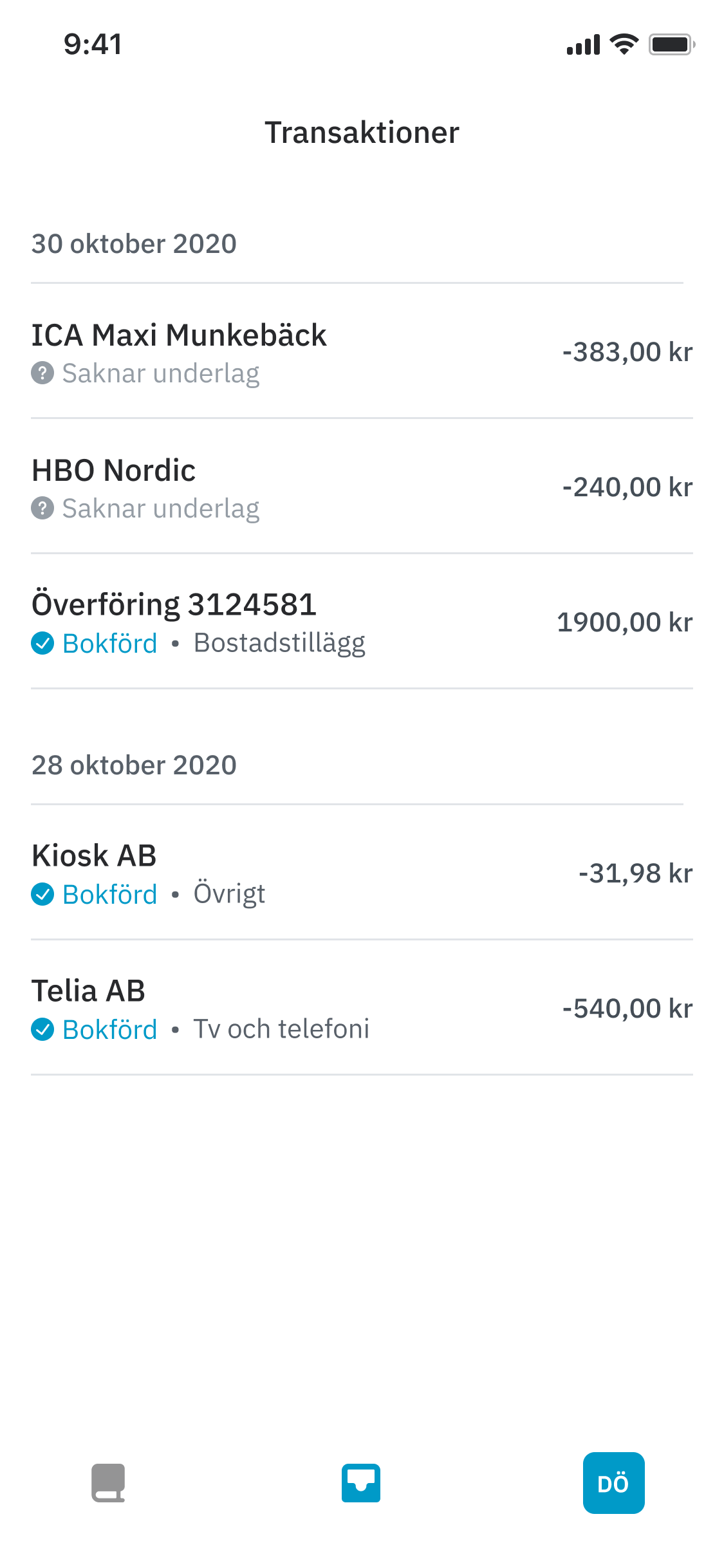

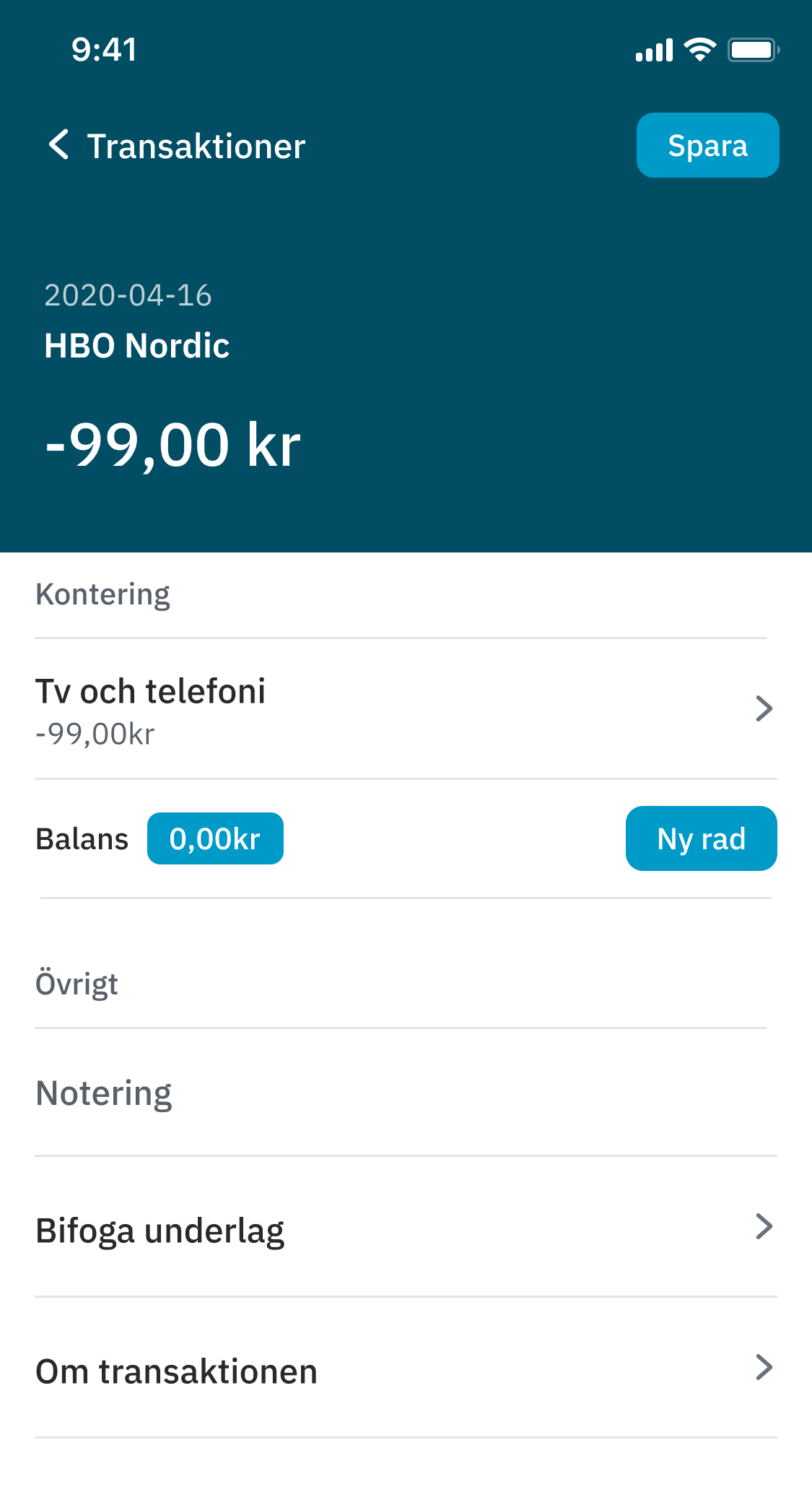

Keeping track of finances can be a daunting task, especially if you're managing multiple clients. It was important that the experience of booking transactions was as smooth as possible. Aider featured a simple accounting tool that allowed trustees to categorize transactions and keep track of their clients' finances.

A single transaction can be split into multiple categories, making it easy to keep track of expenses and income. A balance check is done to make sure that each transaction is accounted for.

Booking transactions in Aider was designed to work for anyones, regardless of their accounting experience.

Journaling

As a trustee you're not only obligated to keep a tidy record of your clients finances, you're also required to keep a journal of your work. This is to ensure that the trustee is doing their job properly and to provide a transparent view of the work done. Aider contains a simple journaling tool that allows you to keep a clean record of your work.

Journals are a record of time spent and can be used to cover expenses.

Keeping Things Personal

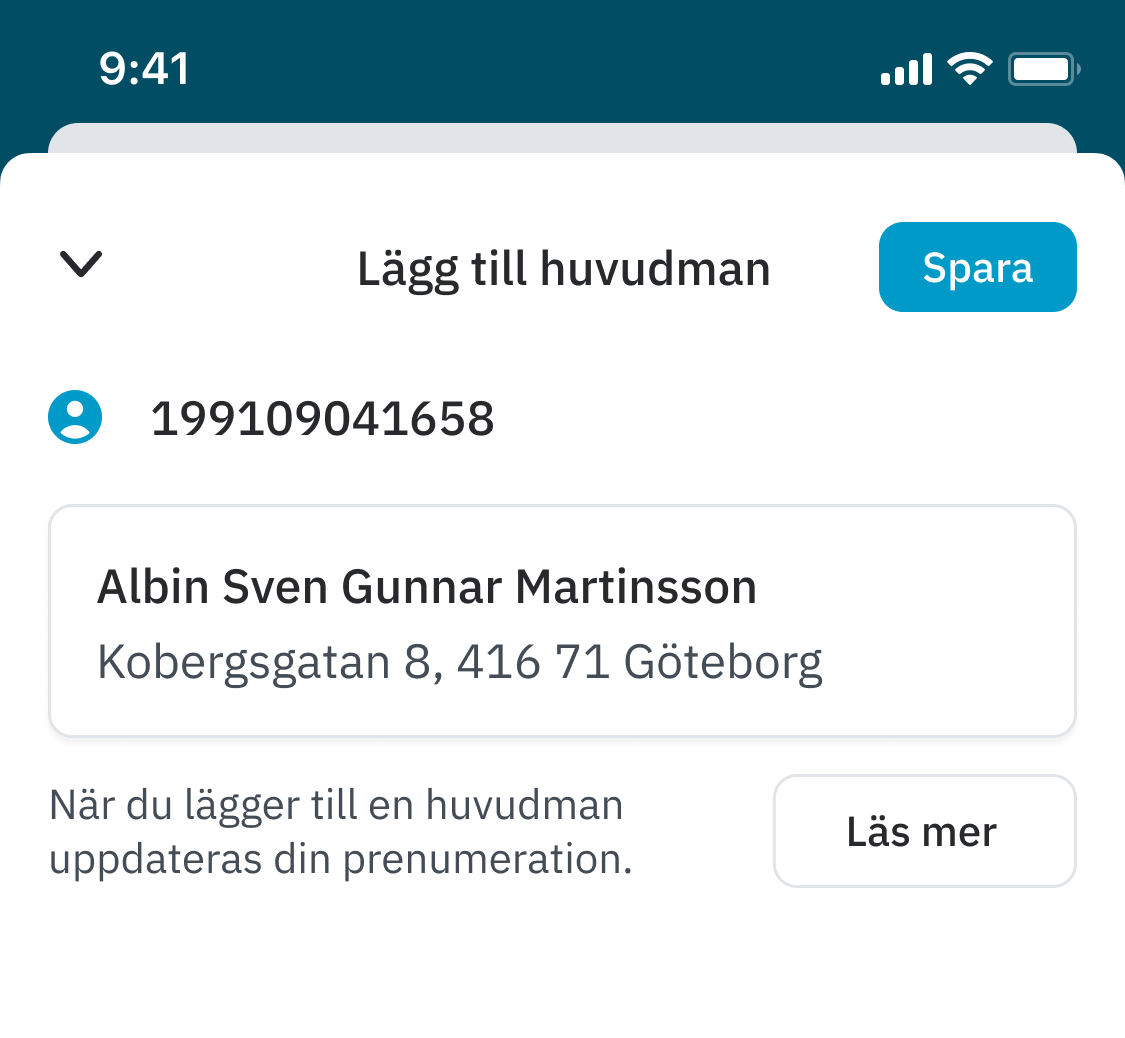

When you add clients in Aider we make sure to confirm their identity through the PIN (Personal Identification Number). This way we can ensure that reports generated through Aider are connected to an actual person.

We fetch personal details from the Swedish population registry to make sure that the person you're adding is the right one.

Working Across Platforms

The Aider native app is designed to be your on-the-fly companion, while the web app provides a more in-depth experience. The web app featured tools for analysing spending as well as generating reports.

With Aider, reporting was just a click away, auto-filled and with smart features to detect accounting errors.

Wrapping Up

The two years I spent working on Aider was a tough but transformative experience. Launching a startup meant navigating countless challenges, from shaping an idea into a tangible product to making tough strategic decisions about financing and scaling. As a designer and developer you really had to take a step outside of your comfort zone and learn new things on the fly. I'm proud of what we accomplished and grateful for the opportunity to work on a project that truly makes a difference in people's lives.

Aider eventuelly went on to merge with another company and is now part of a larger suite of tools for trustees in Sweden.